How business customers from EU place VAT free cross-border orders (Reverse Charge VAT).

When you buy goods or services from suppliers in other EU countries, the Reverse Charge moves the responsibility for the recording of a VAT transaction from the seller to the buyer for that good or service.

At MEMIDOS, business customers from one EU country who are buying goods from a supplier in another EU country, can avoid being invoiced VAT when typing the company’s valid EU VAT number in the checkout section (payment page). The VAT number will be automatically verified in the VIES database.

How does it work?:

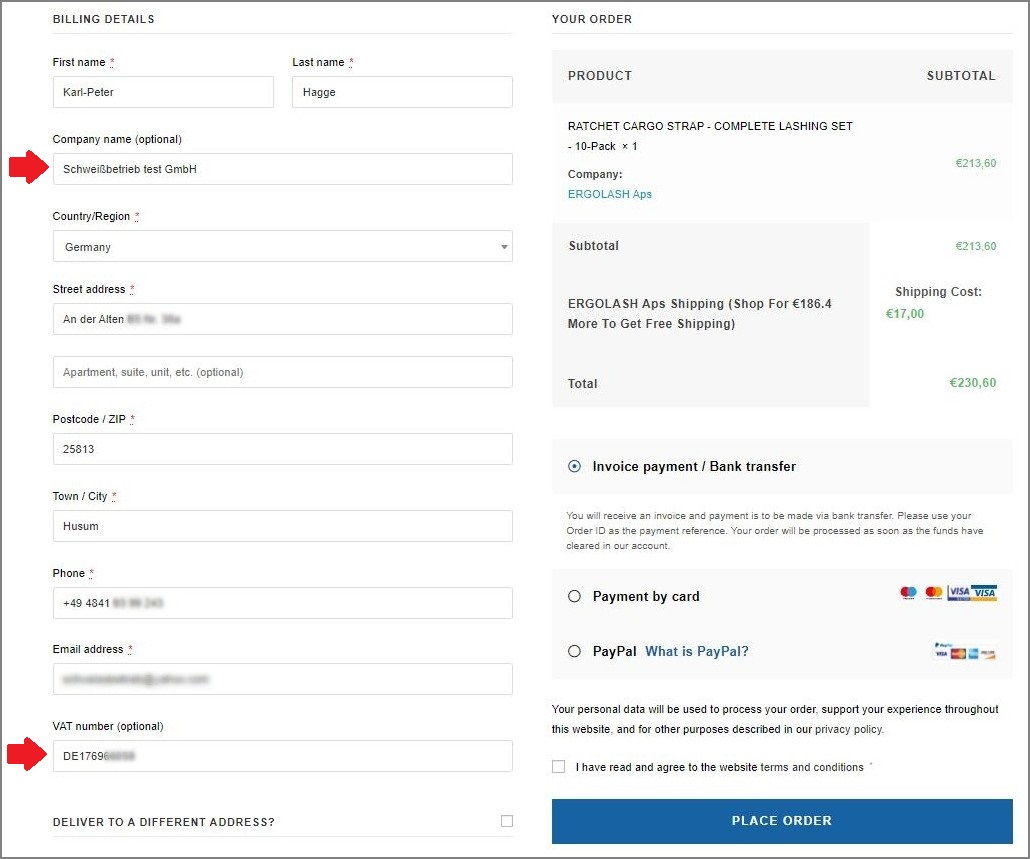

In the checkout section you simply type in your company name and VAT number (syntax example: DE123456789) together with the other required information. At the order overview you will now see that VAT is removed from your order.

Example: